CTOS IDGuard, Malaysia and Southeast Asia’s first application fraud bureau, has prevented confirmed fraudulent credit applications to the tune of RM28 million in the first 12 months of operation, with a further RM51 million in suspicious applications also flagged to partners.

The initial participating group of Maybank, RHB, CIMB, Alliance Bank and Ambank has been joined by BMW Financial Services, while Hong Leong and six other banks are in the midst of implementation.

“We are making large strides in the battle against credit application fraud, and the increase in participating financial institutions only bolsters the effectiveness of CTOS IDGuard,” commented Dennis Martin, Group CEO of CTOS Digital Berhad, the holding company of CTOS Data Systems Sdn Bhd. “Our current partners cover over 65% of the total banking assets in Malaysia. As this grows even further in the coming months, CTOS IDGuard will be the most effective tool available to combat application fraud on the market. By reducing the prevalence of application fraud, we enable financial institutions to pass these savings directly onto consumers in the form of better rates and deals for their required credit.”

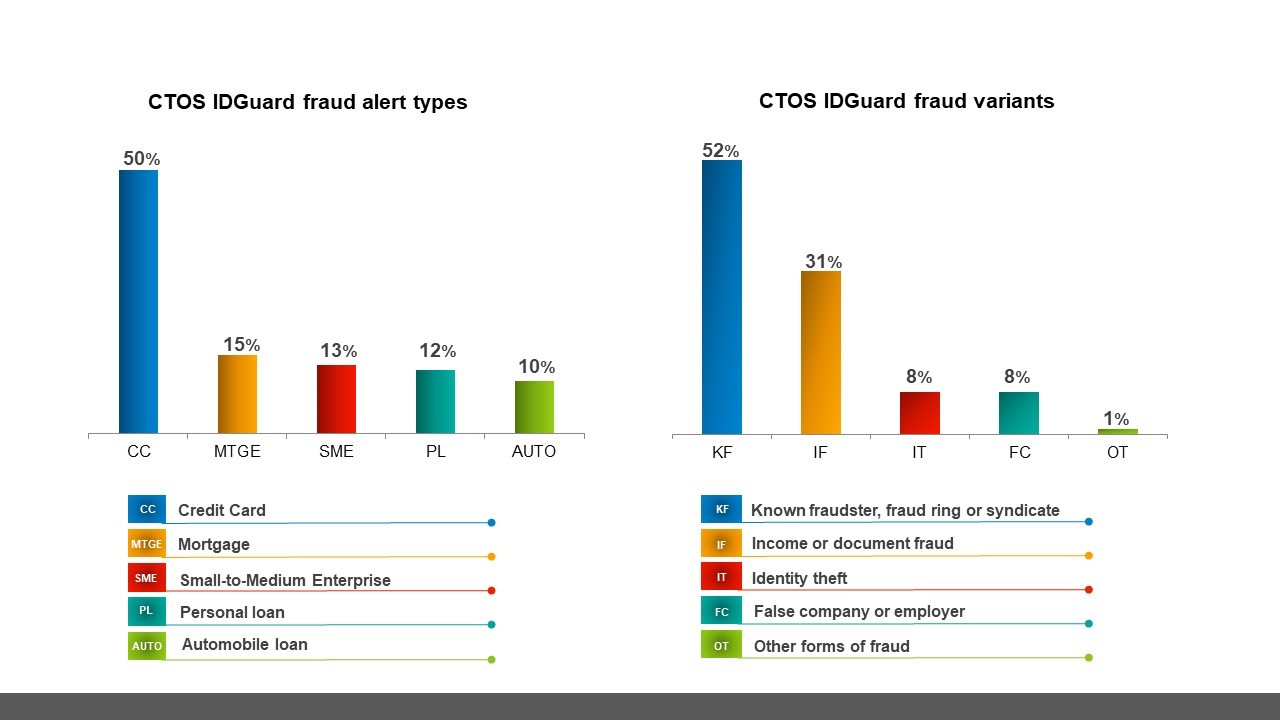

CTOS IDGuard data from the past one year shows that the majority of applications being flagged are credit card applications, which make up 52% of the fraud alerts generated. More significantly, over half of the alerts are due to applications made by known fraudsters or syndicates, which is only made possible through the multiple pools of partner data analysed by the fraud bureau.

Powering the CTOS IDGuard fraud bureau is GBG’s industry leading fraud and financial crime prevention engine. Ensuring continuous enhancement of IDGuard, GBG is currently in the process of incorporating its award-winning machine learning technology to substantially increase the system’s effectiveness of fraud detection accuracy, lower false positive rates, and further improve operational efficiency.

“With the ensuing good results and experience, some of the participating banks are expanding their use of the fraud consortium to additional digital financial products as well as to corporate loans. To manage higher volume of applications and more complex use cases, we are deploying our machine learning technology to bolster fraud detection accuracy and pre-empt emerging vectors for CTOS IDGuard,” explained Dev Dhiman, Managing Director of APAC, GBG.

“Across Southeast Asia, machine learning is the top solution prioritised by financial institutions for fraud and prevention in our recent survey; integrating machine learning into CTOS IDGuard will help to future-proof financial crime management especially in digital channels for participating banks,” concludes Dhiman.

Survey data from GBG has shown that many financial institutions are aware that the potential threat from application fraud is likely to increase, with 51% of Malaysian financial institutions expecting cases involving stolen IDs to increase and 54% expecting scams to increase in the next year.

The global coronavirus pandemic has only accelerated the shift towards the digital realm and the rise in digital banking brings fresh security concerns. The increasing deployment of remote online services by banks that provide customers with convenience to apply for banking products digitally has also heightened risk for the banking industry from non face-to-face interactions. Apart from implementing eKYC for the digital verification of customers’ identity, IDGuard serves as an additional safeguard to prevent potential fraud from digital application.