When officiating Share/Guide’s annual conference this year, deputy minister of of Communications and Multimedia, Eddin Syazlee Shith had said, “I would like to encourage Share/Guide to share these success stories with the general public as well for a wider coverage among IT users in our country.”

One of these success stories is Syarikat Takaful Malaysia Keluarga Berhad (STMKB), one of the leading takaful companies in Malaysia, that has won awards in the category of Best Takaful Company in Malaysia, at least five times consecutively at annual worldwide Takaful summits.

And like many other financial institutions this past decade, it does not remain untouched by technology.

STMKB’s CIO, Patrick Wong attests to this when he recently shared that 2019 will see the introduction of a few major initiatives to further enhance customer experience.

Read on to find out more.

EITN: What are the top 3 challenges of the insurance industry?

Wong: The challenges will differ between Life, General and Health insurance line of business. For health, the escalating medical costs pose to be the most challenging.

For General, it is the sheer numbers of insurers that exist in the market. For Life, the Agency force drives the market. We have to be innovative in our products and services, as well as to give our customers a user friendly Experience.

EITN: How do you use technology/insurtech to address them and achieve your business KPIs?

Wong: For Health insurance, we are using technology to control the escalating medical costs and to perform business intelligent trend analysis. We have a Costs and Utilization Business Intelligene platform that allows our Business Managers to share our Corporate Clients’ claims costs, and have more than 20 charts on trending to assist our Corporate Clients.

In fact, Takaful Malaysia is the first to have a real-time underwriting engine that is able to accept risks in less than 5 mins. Medical card issued and cert issued. You don’t need to wait for 1-2 months as per what the conventional insurers are doing.

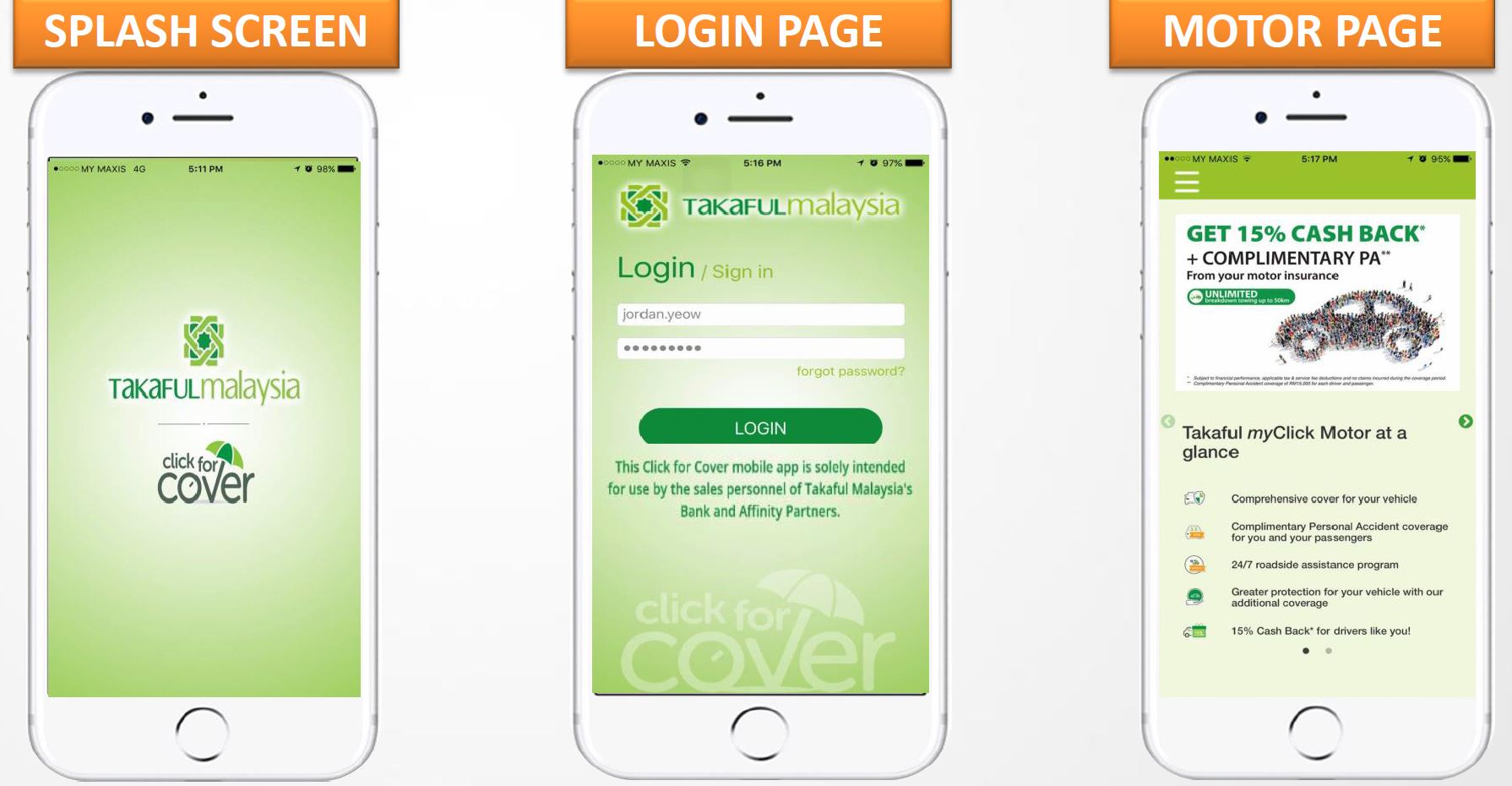

As for General Business, we are adding more products onto our Online Sales Platform (OSP) which allows consumers to buy direct, and also to allow our Intermediaries to sell via the same mobile channel.

We recently just launched myTravel PA for Single and Annual Trips in our OSP website. We have more products coming up by end of this year.

EITN: Customer experience is key. What is your technology roadmap for enhancing the customer journey?

Wong: Customer experience has always been our main objectives for our digital online platforms. If you look at our OSP Motor, by entering just 4 fields, one can get the quotation instantly. This applies to all our products available in OSP.

We have a few major initiatives in 2019 to further enhance the customer experience. Imagine being able to perform all purchases, and servicing online. Imagine if you can ask for products and service advice 24/7. This is the roadmap towards which we are heading and this will involve a major revamp to our Customer and Intermediaries Portals.

EITN: Motor insurance and health insurance? Do they have unique regulatory-based challenges compared to other types of insurance ie. Life, Accident etc

Wong: As explained earlier, these 3 lines of business differ from the regulatory view point.

High medical costs are the main challenges for health insurance. Motor Insurance also needs to be monitored especially in the claims area involving certain makes /models of vehicles which can prove to be higher than the rest.

Our very proactive Actuarial team constantly monitors these high-risk classes of business and are able to detect any abnormalities and institute immediate price adjustments.

With the introduction of Balance Score Cards for Life insurance, there will be more stringent control from the regulators for the commission payout and allocation to the insured. Takaful Malaysia focuses more on health and general insurance.

EITN: Just need your opinion and thoughts about InsurTech industry locally and globally.

Wong: If the insurer is new to digital strategy/initiatives, they will need help from InsurTech either locally or globally to get started. Not many companies have strong CEO`s who are visionaries and can appreciate the value of digital strategy.

These companies embarking on the digital sphere must also have a strong IT team to fulfil these visions. Probably local InsurTech could be cheaper than their global counterparts. Other than that, I do not see any difference between local and global players. I believe local InsurTech players can also do the job as well as any global InsurTech.

EITN: How do you apply InsurTech technologies in your organisation?

Wong: We have partnered with Fusionex for the front-end technology. They provide the technology for the sales portal framework, and mobile application framework.

However, the framework is meaningless without the business rules from Syarikat Takaful Malaysia Keluarga Berhad (STMKB).

We have built a robust interface between the front-end with our insurance core systems, and workflow systems to ensure all transactions flow seamlessly and to ensure our customers have a unified experience when dealing with STMKB.